How to Build a Hyper-Local Food Delivery Marketplace That Rivals UberEats

- 26.01.2026

- By: Foodappsco

UberEats wins on scale, but hyper-local platforms win on focus. If you’re building in a single city, district, or even a tight set of postal codes, you can outperform larger aggregators on the things that matter to local customers and restaurants: faster delivery reliability, better menu accuracy, tighter customer support, and smarter partner relationships. The goal isn’t to “outspend” UberEats. The goal is to out-execute them locally.

A hyper-local strategy works because the operational complexity is smaller and the feedback loop is faster. You can learn what customers actually want (and what restaurants can realistically deliver) in days, not quarters. You can also structure incentives differently: restaurants often prefer predictable fees and ownership over paying commissions forever. This is where a marketplace operator can build long-term loyalty with merchants while still delivering a great customer experience.

Start With a City-Level Wedge, Not a “Big Bang” Marketplace

Most marketplaces fail because they launch too wide. Hyper-local marketplaces succeed by starting with a wedge: a tightly defined geography and a tightly defined use case. Pick a zone where delivery times are naturally short and order density can build quickly—think dense residential areas, student zones, office clusters, or neighborhoods with strong restaurant variety.

Instead of onboarding 100 restaurants across a whole city, onboard 15–25 restaurants in a compact delivery area and make them perform exceptionally well. The only KPI that matters early is repeat orders. Repeat orders come from consistent delivery time, accurate orders, and reliable customer support—not a giant restaurant list.

Operationally, define a “launch box” with clear boundaries. Your first zone should allow 15–35 minute delivery for most routes, and you should be able to staff support without chaos. Once the first zone is stable, copy-paste the playbook to the next zone.

Define Your Marketplace Positioning in One Sentence

If you can’t explain your marketplace in one sentence, you’ll struggle to acquire restaurants and customers efficiently. Hyper-local winners usually anchor around one of these positioning angles:

- Speed: “Fastest delivery in this neighborhood.”

- Selection: “Local favorites you can’t find on aggregators.”

- Price: “Better prices because we don’t charge massive commissions.”

- Quality: “Verified kitchens, fewer cancellations, better service.”

- Community: “Support local restaurants; keep money in the city.”

Pick one primary angle and execute it hard. You can add secondary angles later, but early clarity makes marketing, sales, and product choices much easier.

Choose the Right Business Model: Commission, Subscription, or Hybrid

Your business model defines how easily you can recruit restaurants and how sustainably you can grow. UberEats-style commissions are familiar but often disliked by restaurants. Subscription models can be attractive for restaurants if the platform reliably drives orders. A hybrid model often works best for hyper-local: a lower commission plus a fixed monthly fee for premium placement, marketing bundles, or operational tools.

Here’s the practical lens: early on, you need restaurants to say “yes” quickly. If your fee structure feels risky, adoption slows. Consider an introductory plan that reduces merchant friction, then migrate merchants to sustainable plans once order volume is proven.

Whatever you choose, make the pricing easy to understand. Confusing pricing kills restaurant conversions. Keep it simple: what they pay, what they get, and what happens if order volume changes.

Build the Supply Side First: The Restaurant Onboarding Playbook

Restaurants are not “users.” They’re operational partners. Your onboarding process must be lightweight, fast, and designed to reduce their work. For your first 20 restaurants, do as much as possible for them: menu digitization, photos, category mapping, opening hours, delivery settings, and initial promotions.

A strong onboarding playbook includes:

- Menu import (from PDF, website, POS export, or manual setup)

- Product naming standards to reduce customer confusion

- Modifier and add-on structure (sizes, spice levels, toppings)

- Prep time rules by daypart

- Packaging and handoff checklist

- “Out of stock” and substitution rules

Also define restaurant tiers. Not all restaurants deserve equal exposure early. Promote those who can consistently fulfill orders, keep prep times stable, and handle peak hours without cancellations. Your marketplace reputation depends on your best operators.

Design the Customer Experience Around Reliability, Not Features

Customers don’t care how many features you have; they care whether the food arrives on time, correct, and warm. If you want to rival UberEats, build trust through consistency. That means accurate ETAs, proactive communication, and quick resolution when issues happen.

For your customer experience, prioritize:

- Clear delivery time promises (don’t overpromise)

- Real-time order status updates

- Simple re-order and favorites

- Reliable refunds/credits workflow

- Fast support response (even if it’s just WhatsApp + backend at first)

In hyper-local markets, word-of-mouth is powerful. A few bad experiences can hurt disproportionately, but consistent delivery creates loyalty quickly—especially when competitors are inconsistent in that neighborhood.

Operations Win Hyper-Local: Delivery Fleet Strategy That Scales

Delivery is where hyper-local marketplaces either win or implode. Start with a model you can control, then expand. You have three realistic options:

- In-house riders: More control, higher fixed cost, stronger reliability.

- Contract drivers: Flexible cost, requires strong dispatch and incentives.

- Hybrid: In-house riders for peaks + contractors for overflow.

For hyper-local, a hybrid approach is often best. You keep a small reliable core fleet and add flexible capacity. The key is dispatch discipline: prevent long pickup waits, minimize batching early, and control delivery radius per restaurant. If you’re late, your marketplace loses trust quickly.

Also, set rider KPIs that focus on customer outcomes: on-time rate, pickup wait time, delivery completion rate, and complaint rate. Don’t chase “number of deliveries” without quality.

Technology Stack: What You Actually Need to Launch (and What You Don’t)

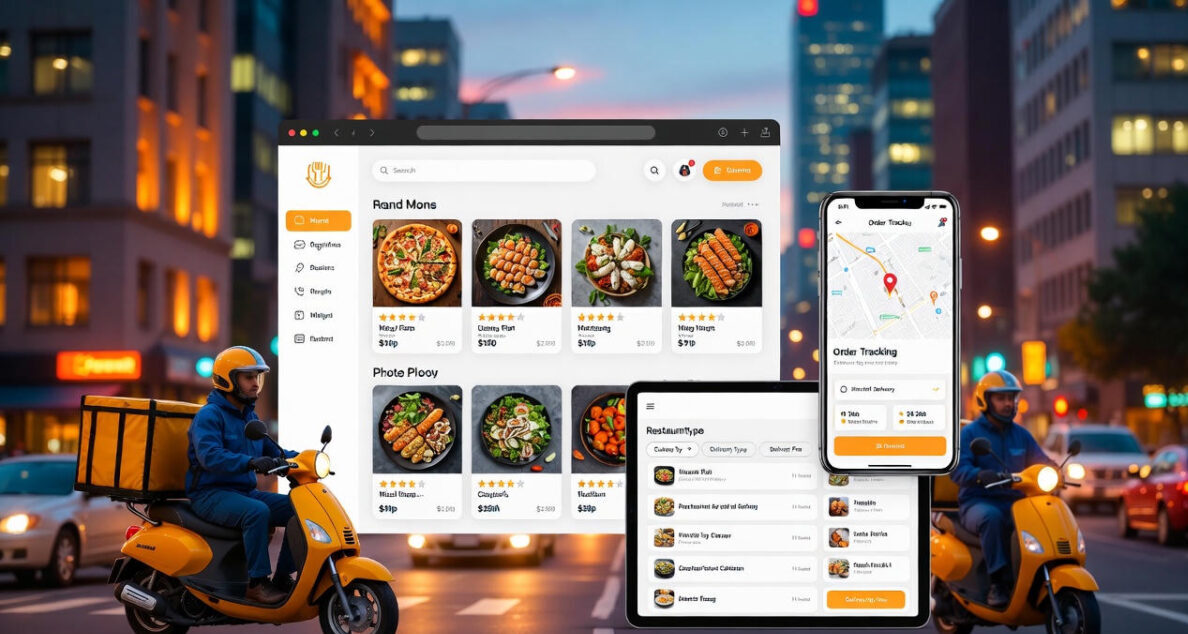

You don’t need to build everything from scratch to compete. What you need is an operationally solid system: merchant management, customer ordering, rider workflow, dispatch visibility, and analytics. If you’re evaluating platforms, focus on the basics that reduce operational friction and allow you to control quality.

Minimum viable system components:

- Customer ordering website (and optionally apps)

- Restaurant portal/app for order acceptance and status

- Rider app for pickup/dropoff, navigation, and proof of delivery

- Admin panel for managing merchants, zones, pricing, and support

- Payment processing and settlement logic

- Basic reporting (orders, refunds, commissions/subscriptions)

If you want a faster path to market with a proven feature set, you can launch using an On-Demand Food Delivery Marketplace platform and focus your energy on execution: onboarding, delivery reliability, retention, and local growth.

Food Delivery Marketplace Cost: Budgeting Like an Operator, Not a Dreamer

Most founders underestimate total cost by only thinking about software. Your real cost structure includes operations, marketing, support, and retention incentives. You should budget in three buckets: platform cost, launch cost, and monthly operating cost. The platform cost is your base. Launch cost covers branding, onboarding, and initial marketing. Monthly operating cost includes fleet incentives, support, promotions, and payment fees.

To plan accurately, review your expected Food Delivery Marketplace Cost and align it with the operational plan for the first 90 days. A clean model includes target order volume, average basket size, gross margin per order, rider cost per order, and a budget for promotions to drive repeat purchases.

One practical approach: design your unit economics so you can scale without burning cash. If each order loses money, growth only accelerates losses. Your marketplace should either be contribution-positive early, or you should know exactly when and why it becomes positive (and what levers control it).

Acquire Customers Locally: Channels That Work Right Now

Hyper-local acquisition is different from national growth. You can win with low-cost channels if you’re disciplined. Focus on channels that produce high-intent orders:

- Local SEO: neighborhood pages, “food delivery near me” zone pages, restaurant pages

- Google Business Profile: posts, offers, Q&A, and review generation

- Flyers + QR codes: near offices, dorms, gyms, and apartment lobbies

- Restaurant co-marketing: table tents, receipts, and in-store signage

- Referral credits: simple double-sided rewards (giver + receiver)

- Local influencers: micro creators in your city, not national accounts

The play is simple: drive first orders, then obsess over repeat orders. If your repeat rate is strong, paid acquisition becomes optional. If your repeat rate is weak, paid acquisition will drain you.

Retention: The Real Weapon Against Aggregators

UberEats can buy downloads; you can build loyalty. Retention in hyper-local marketplaces comes from predictable service and smart post-order loops. Implement a retention system that turns first-time customers into habitual users:

- Re-order reminders for favorite restaurants

- Weekly neighborhood offers (not random discounts)

- Time-based nudges (lunch, dinner, weekend)

- Credits for late deliveries (only when needed, not as a default)

- Simple loyalty points that unlock free delivery or add-ons

Also, treat customer support as marketing. In a local market, how you handle a mistake matters more than the mistake itself. Fast, polite resolution creates trust and repeat usage.

Restaurant Retention: Keep Merchants Happy Without Discounting Your Whole Business

Restaurants churn when they feel the marketplace is unpredictable or unfair. Reduce churn by making performance transparent and giving restaurants tools to succeed. Share simple reports: order volume, peak times, cancellation reasons, and customer feedback.

Merchant retention tactics that work:

- Featured placement based on fulfillment quality, not only fees

- Marketing bundles (push offers, banner slots, local campaigns)

- Operational coaching (prep-time tuning, packaging, menu optimization)

- Clear payouts and settlement schedules

- Support channel dedicated to merchants during peak hours

When merchants see predictable orders and fair economics, they will promote your platform inside their own store—giving you free customer acquisition.

Metrics That Matter: What to Track Weekly in the First 90 Days

If you want to rival UberEats locally, you need tight operational metrics. Track these weekly and act immediately when something slips:

- On-time delivery rate

- Average delivery time (by zone and restaurant)

- Order acceptance rate (restaurants)

- Cancellation rate (restaurant vs rider vs customer)

- Refund/complaint rate

- Repeat order rate (7-day and 30-day)

- Customer acquisition cost (if running ads)

- Contribution margin per order

Most marketplaces don’t die because of “competition.” They die because they stop managing quality at the operational level.

Scaling City-by-City: Copy the System, Not Just the App

Scaling is not adding more restaurants. Scaling is repeating a proven operating system. Once your first zone is stable, document everything: onboarding scripts, rider SOPs, support macros, promo rules, payout schedules, and escalation steps. Then replicate the playbook to the next zone with minimal variation.

When expanding, keep the same “density first” principle. Don’t stretch delivery radius to chase more orders; it usually reduces delivery quality and increases refunds. Expand in compact clusters and build order density before moving to the next cluster.

Conclusion: How to Rival UberEats Locally Without Playing Their Game

To build a hyper-local food delivery marketplace that rivals UberEats, focus on what large aggregators struggle to perfect in every neighborhood: consistent operations, merchant relationships, and real customer loyalty. Choose a small zone, perfect reliability, and build repeat usage before you expand.

Use a proven platform approach to accelerate time-to-market, then invest your energy in the hard part—execution. If you want to launch faster with a complete marketplace foundation, explore an On-Demand Food Delivery Marketplace solution and plan your rollout with clear unit economics and a realistic Food Delivery Marketplace Cost model. Hyper-local winners aren’t the biggest—they’re the most consistent.